I feel like a bit of a hypocrite writing this one—while I’m not a ride-or-die fan of APs, I certainly find a lot of them really, really cool—just yesterday I was hyping up the Audemars Piguet Royal Oak Concept Ref. 26587TI.OO.D010CA.01 in titanium that producer-turned-luxury-mogul Pharrell will be auctioning on his platform JOOPITER this week.

But that drop—like so many Royal Oaks lately—may not go nuclear in the resale market. Because here’s the kicker: for the first time since 2022, certain Audemars Piguet models are now selling for less than retail. The brand that once laughed in the face of availability is suddenly… everywhere. And it’s not just the odd model or two. Entire categories like the Code 11.59 and Offshore lines are facing heavy markdowns on the secondary market, while even standard Royal Oaks are losing steam.

Let’s dig into how the mighty fell—and whether it’s a fall worth celebrating:

The Bubble Didn’t Just Pop—It Deflated

Between 2021 and early 2023, Royal Oaks were trading at 2–3x retail like it was nothing. Boutique staff were ghosting loyal clients. Flippers were walking out of stores and into six-figure profits. It felt like AP could do no wrong. But here’s the thing: AP isn’t just another luxury watchmaker. There’s no official ‘Big Three Index’—but there might as well be. Rolex, Patek Philippe, and Audemars Piguet are the most traded, most analysed, and most emotionally loaded names in the secondary watch market. And right now, AP is the one blinking red.

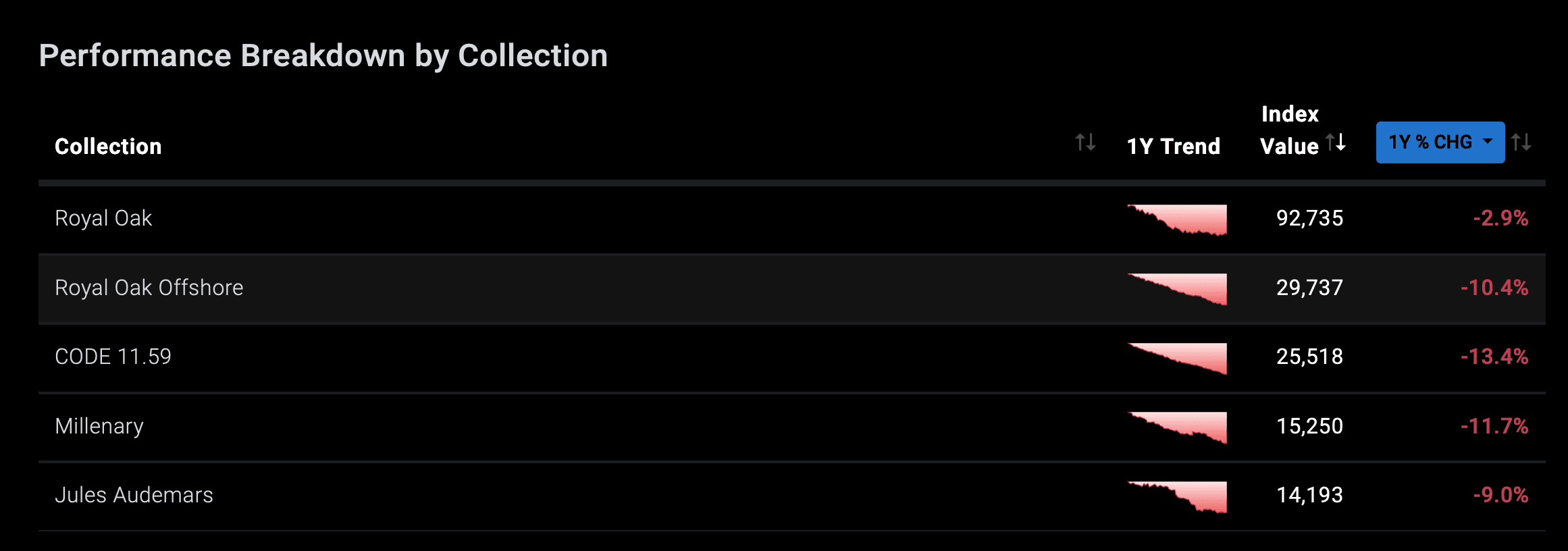

According to WatchCharts and Morgan Stanley, prices for AP’s most-traded models have dropped over 70% since their 2022 peak. Royal Oak Offshores are now trading at 23% below retail. Code 11.59s? Down 33%. Even the flagship Royal Oak—which still carries a modest premium—is seeing its resale gap shrink, down 5.5% year-on-year. For context, Rolex’s tracked models have lost around 40% in the same timeframe. Patek has actually held its ground, even rising slightly in Q2. But AP? It’s leading the slide, and not in a good way.

That’s before we even factor in the threat of US import tariffs introduced earlier this year—one that effectively wiped out flipper margins overnight. Dealers rushed to move stock ahead of the deadline, flooding the secondary market with lightly worn inventory. For a brand that built its reputation on scarcity, it’s a dangerous level of visibility.

Did AP Get Too Clever For Its Own Good?

Let’s talk strategy for a second. Audemars Piguet was early to ditch third-party retailers in favour of boutique-only sales. It was bold, it was luxury-coded—and it gave them full control of the customer experience. But in cutting out ADs, they also severed a layer of friction that once kept grey market speculation at bay. The flippers didn’t die out—they just went direct.

At the same time, AP ramped up production on lesser-loved lines. The Code 11.59, despite eventually winning some design respect, launched with pricing that felt out of touch. And the Offshore, once the bad boy cousin of the Royal Oak, has grown bloated with endless colourways and limited editions. Add it all up, and the brand feels less curated, more commercial. Which is fine—if the resale market’s healthy. But right now, it’s not.

So...is it time to buy? Depends who you are. If you’re a collector with an eye for historical references, this is your moment. The hype has cleared, the pricing’s sane, and you can now buy references like the 14802ST or 5402SA without needing to sell a kidney. Two-tone, gold, moonphase, QP—take your pick. There are deals to be had.

If you’re a flipper? The party’s over. The resale margins are gone, the buyers are pickier, and even Rolex isn’t the guarantee it used to be. And if you’re new to watches (and flush with disposable income)? The Royal Oak market is your crash course in how fast hype can curdle. Buy what you love, not what the algorithm told you to.